Gender Impact Investing & the Rise of False Solutions: An Analysis for Feminist Movements

4 min read · January 2023

Sanam Amin and Diyana Yahaya, The Association for Women’s Rights in Development (AWID)

Summary

Gender Impact Investing (GII) is an investment strategy that aims to promote gender equality, but there is still no common standard or definition of what constitutes “gender-based factors” or “gender analysis” in this type of investing. Despite this, GII has grown in popularity and volume over the last few years. However, it is difficult to assess the true numbers behind it as most available figures are based on self-reported estimates, which lack verification or accountability.

GII is still a small fraction of the impact investment industry, but it is sizeable compared to funding committed to feminist movements and women’s rights organizations. Out of approximately USD$630 to USD$715 billion for impact investments in 2019, USD$5 billion were investments for gender impact. At the same time, the Official Development Assistance (ODA) to women’s rights organizations accounted for only USD$707 million or just above one percent of all gender-focused aid.

There is a risk of thinking that financing for GII is the same as funding feminist agendas and gender equality. Despite the lack of evidence about its substantive contribution to social change, many organizations, development finance institutions, multilateral banks, and other public entities have invested significant money to attract commercial capital into GII. GII continues to privilege private capital and economic elites, which can lead to more financialization.

Methodology

The research and analysis were carried out in four stages from November 2021-September 2022:

Stage 1: Desk research on Gender Impact Investment (GII) and Gender Lens Investment (GLI), incorporating initial data gathered earlier by the AWID team.

Stage 2: Workshops and presenting initial findings to experts for validation, discussion, and strategic assessment.

Stage 3: Five key informant interviews of individuals in the investment industry and institutions involved in promoting gender impact investment, as well as other actors promoting these investments

Stage 4: Two additional interviews as well as the #BlockBlackRock campaign, a feminist-led collective pushback against the UN Women’s partnership with BlackRock, the world’s leading investment firm, specifically to promote GII.

Key Findings

The premise behind GII is that there is not enough investment in women-led businesses. These types of investments can generate substantial economic growth because of the perceived benefits and stability offered by women-led businesses. The goal of GII is to use finance and investment capital for social change, gender equality, and to address structural inequities.

There is no agreed definition of ‘gender-based factors’ or ‘gender analysis’ in GII, so the gender impacts or goals for GII vary from investor to investor.

How big is the money in GII?

It is difficult to assess the true numbers behind Gender Impact Investing (GII). The figures available across different reports are mostly based on investors’ self-reporting, which is without verification or a standard form of accountability.

GII is still small in the context of impact investing, but it is increasing annually and significantly when compared to the amount of development funding going to feminist movements, especially in the Global South.

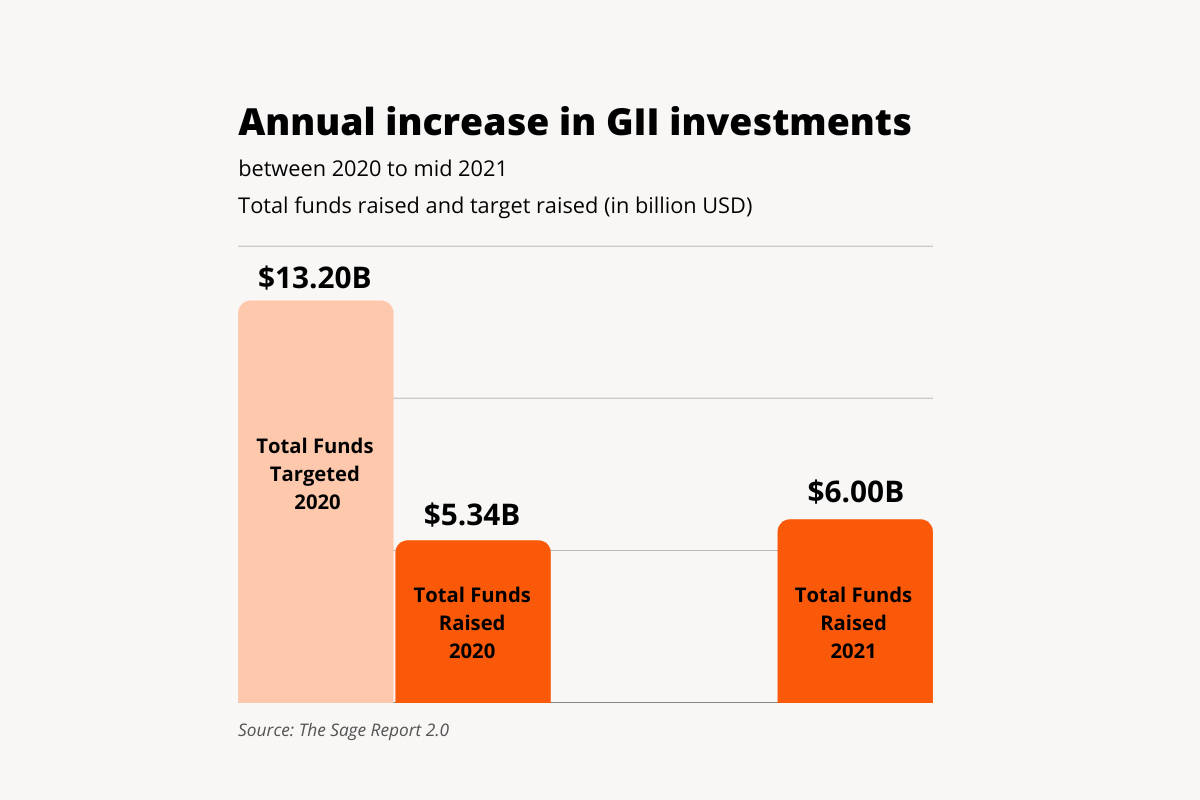

Total amount of impact investments in 2020 was USD$636 billion; of that USD$5.34 billion was for GII (figure 3).

The amount of funds raised for GII in the first half of 2021 was USD$6 billion which is already higher than that of 2020, USD$5.34 billion (see figure).

Where does the money come from?

A significant amount of public money has been diverted by development finance institutions (DFIs), multilateral banks, and other entities to GII, despite little evidence of GII’s actual contribution to positive social change.

According to a 2020 Organization for Economic Co-operation and Development (OECD) Survey, USD$49.8 billion (67%) of assets under the management of blended finance vehicles reported either integrating or being dedicated to gender equality, and 77% of the capital in blended finance vehicles dedicated to gender equality came from governments and development agencies.

Where is GII going?

Geography: The distribution of GII is deeply unequal between the Global South and the Global North. The majority of GII is focused on the US and Canada, followed by Sub-Saharan Africa, Latin America and the Caribbean, South Asia, and Southeast Asia.

Sector: GII targets a wide range of sectors: healthcare being the top, followed by agriculture, fintech, and education and training. But GII can increase the financialization and undermine gender justice in sectors such as healthcare and education, which can best address gender inequalities when they are public.

The Rise and Risks of GII

The increased interest in GII is part of "Woke Capitalism" — a new wave of multi-stakeholderism that asserts that duty bearers, rights holders, and corporate interests are all 'equal partners,' despite significant power imbalances.

The amount of money being invested towards supporting gender equality may sound exciting, but it is largely public money subsidizing private sector investments and not the other way around.

The lack of common definitions and standards within GII opens the door to investors to carry out pink- or green-washing exercises.

Takeaways

Gender Impact Investing (GII) is a way of investing money to promote gender equality, but there is no clear definition.

The popularity and volume of funds in GII have been increasing over the last few years, but it is difficult to assess the true numbers behind it as most figures are based on self-reporting. Therefore it is important to assess how capital flows in the sector.

Despite GII being a small fraction of the impact investment industry as a whole, it is sizeable compared to the funding committed to feminist movements and women’s rights organizations.

Read the full report here.

References

Turner, H. (2022). Overlooked: Canada’s Fastest-Emerging, Highest-Educated Workforce. Pink Attitude – Empowering South Asian women.